Digital stamping has transformed the way stamps work in India. The Ministry of Finance now accepts it as a legal method to verify documents. Twenty states and union territories have merged with digital stamping platforms, making the process more secure and available to everyone.

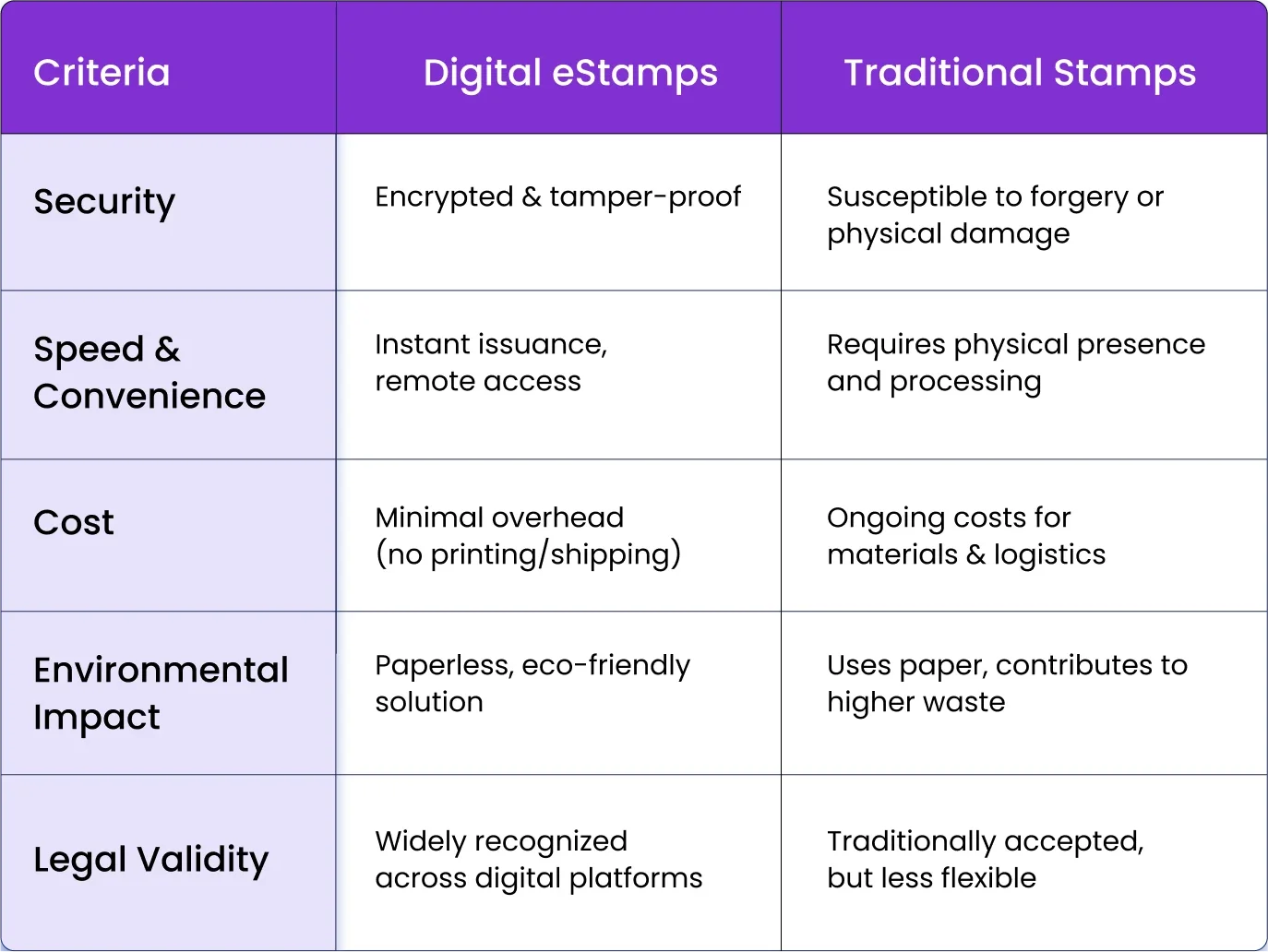

Document stamping is a vital part of validating legal and financial transactions, whether through traditional physical stamps or modern e-stamps. Each type of stamp has its own purpose, and requirements change based on state and document type. Physical stamps need manual verification, but e-stamps can be verified online instantly. Digital stamps come with unique identifiers and security features that substantially lower the risk of forgery. They also eliminate the costs of buying and storing physical stamps.

This piece explores stamp options in India, and their uses, and helps you pick the right type for your documents.

Understanding Different Types of Stamps in India

The Indian Stamp Act of 1899 created four main types of stamps that serve different purposes in legal and financial transactions.

1. Non judicial stamp paper forms the basis of many business and property transactions. These stamps help verify documents like business contracts, property transfers, and powers of attorney. The stamps include watermarks to prevent counterfeiting and ensure document authenticity.

2. Judicial stamps, which include court fee stamp papers, help with legal proceedings. You can find these stamps in denominations from Rs. 50 to Rs. 25,000. The Court Fees Act of 1870 governs these stamps and makes them necessary for filing cases and submitting legal documents.

3. Revenue stamps are crucial in financial transactions. Section 30 of the Indian Stamp Act requires a Re. 1 revenue stamp for cash transactions above Rs. 5,000. These stamps authenticate receipts and ensure proper documentation of financial exchanges.

4. E-stamps came through the Stock Holding Corporation of India Limited (SHCIL) as a modern way to verify documents. The system works in all district and taluka headquarters. Twenty states and union territories now work with SHCIL to generate stamp duty certificates immediately. This digital option offers quick verification and better security features through the Central Record Keeping Agency (CRA).

Each stamp type has specific denominations and requirements based on state rules. Non-judicial stamp papers range from Rs. 5 to Rs. 25,000, while judicial stamps start from Rs. 50. The document's nature and legal purpose determine which stamp type you need.

How to Choose the Right Stamp Type

You need to think over both document requirements and state regulations to select the right stamp type. The first step is to identify why you need the document.

1. Document Type Requirements

The nature of the legal document drives the selection process. Some instruments must have impressed labels, especially those you execute outside the state. Non-judicial stamp paper works best for business contracts and property transfers. Documents like bills of exchange, share transfers, and broker notes just need adhesive stamps.

Here's everything in stamp selection you should think over:

- Where you execute the document

- How often do you use stamps

- What type of legal transaction do you need

- The quality of impression you want

2. State-Specific Regulations

States have their own stamp duty rules and requirements. The stamp duty rates change substantially between states of all sizes. These rates range from 3% to 7% of the transaction value.

Stamp papers stay valid for six months from purchase. In spite of that, e-stamps never expire. State governments set specific denominations for various stamp types. To cite an instance, non-judicial stamp papers come in values from Rs. 5 to Rs. 25,000. This range helps handle different transaction values.

Missing proper stamps leads to legal issues. Courts won't accept unstamped documents as evidence. Each state has its own templates to meet local rules. You must buy stamp papers in one of the transaction party's names to keep them legally valid.

3. Stamp Paper Values and Their Applications

Stamp paper values in India change based on different legal and financial transaction requirements. The original stamp duty ranges between 5-8% of the property value. Some cases may include extra charges of about 1%.

100 Rs Stamp Paper: Common Uses

The 100 rs stamp paper forms the foundation for many legal documents. This specific denomination helps execute multiple transactions like affidavits, lease agreements for terms under 11 months, and power of attorney documents. Legal matters become more practical with its three-year validity period from the purchase date.

High-Value Stamps for Property Documents

Property transactions just need higher-value stamps that follow state-specific rules.

Several factors determine stamp duty calculations:

- Property location - urban areas usually have higher rates

- Property type - residential versus commercial classifications

- Property age - older properties might qualify for lower rates

- Buyer's gender - some states give concessions to female buyers

Each state has its own stamp duty rates. To cite an instance, see these variations:

- Maharashtra: 5% for female buyers, 6% for male buyers

- Rajasthan: 4% for female buyers, 5% for male buyers

- Gujarat: 4.90% uniform rate

- Punjab: 5% for female buyers, 7% for male buyers

Property transactions of high value typically use stamp papers worth Rs. 5,000 to Rs. 25,000. Documents could become legally unenforceable with inadequate stamp paper values. The final calculation looks at the higher value between the agreement value and property's market value.

Digital vs Physical Stamping Methods

Stamp duty payment methods have changed a lot in India. You can now choose between old-school and modern ways to pay. The Stock Holding Corporation of India Limited (SHCIL) now keeps track of e-stamping records in many states.

E-Stamping Process Explained

Getting an e-stamp is quick and simple through authorized vendors. Here's what you need to do:

- Create your account on ZoopSign Dashboard.

- Reach out to place your order

- Pay the stamp duty

- Get your e-stamps in the inventory

States like Maharashtra and Haryana have built their own e-stamping systems. Maharashtra gives you an e-challan with unique numbers, while Haryana lets you add digital e-stamps right to your electronic documents. But fortunately, you can access stamps of both states on the ZoopSign portal.

Traditional Physical Stamping

The old way of stamping needs you to visit stamp vendors in person. You buy adhesive stamps or stamp papers and stick them on your documents by hand. You must be careful when calculating stamp duties and putting the stamps on documents. One mistake could make your document invalid.

Cost Comparison and Accessibility

E-stamping saves money because you don't need to buy, store, or move physical stamps around. The traditional way costs more due to paperwork and travel.

You can get e-stamps any time you want from authorized centers. Each stamp has a unique number that's easy to check, which helps stop fraud. Physical stamps aren't always available and take longer to verify.

Checking if an e-stamp is real is as simple as going online and looking up its unique number. This makes e-stamps perfect for businesses that work remotely.

Conclusion

Stamps play a vital role in proving legal and financial transactions right across India. People need to understand different stamp types, their uses, and rules to make smart choices about document validation.

Physical stamps come with their own set of problems. They're hard to store, verify, and obtain. E-stamps solve these issues with security features built right in. They offer quick verification and simplified processing. Twenty states and union territories now use digital stamping, which shows how people trust this secure and quick alternative.

Each state has its own rules about stamp paper values and uses. Property transactions need special attention because stamp duties vary from 3% to 7%. These rules and specific documents need to help people pick the right stamp types and values.

Digital stamping platforms cut costs, boost security, and let you verify documents instantly. ZoopSign's eStamp services give you a reliable way to validate your documents securely and quickly. The move to digital solutions has changed document verification for the better, and it keeps getting more accessible and secure.

This new way of stamping shows how technology moves forward while keeping everything legally valid for business and property deals. As more people choose digital options, knowing both old and new stamping methods helps them handle document requirements better.

FAQs

1. What are the main types of stamps used in India?

There are four primary types of stamps in India: non judicial stamp paper, judicial stamps, revenue stamps, and e-stamps. Each serves specific purposes in legal and financial transactions, with requirements varying by state and document type.

2. How does e-stamping differ from traditional physical stamping?

E-stamping is a digital alternative that offers instant online verification, unique identifiers, and built-in security features. It eliminates costs associated with physical stamp procurement and storage and reduces forgery risks. Physical stamping, on the other hand, requires manual verification and has limitations in availability.

3. What factors should be considered when choosing the right stamp type?

When selecting a stamp type, consider the document's purpose, execution location, frequency of stamp usage, type of legal transaction, and required impression quality. Additionally, be aware of state-specific regulations, as stamp duty rates and requirements vary across different states.

4. What are common uses for a 100 rs stamp paper?

A 100 rs stamp paper is commonly used for various legal documents, including affidavits, lease agreements for terms under 11 months, and power of attorney documents. It has a validity period of three years from the purchase date.

5. How do stamp paper values differ for property transactions?

Stamp paper values for property transactions are typically higher and vary based on factors such as property location, type, age, and the buyer's gender. State-wise stamp duty rates range from 3% to 7% of the property value, with high-value transactions often requiring stamp papers ranging from Rs. 5,000 to Rs. 25,000.