Mergers and acquisitions (M&A) are among the most significant transactions in the corporate world. Whether driven by the need for growth, market expansion, or cost synergies, M&A plays a key role in shaping industries, companies, and economies globally. However, the M&A process is complex, requiring strategic planning, extensive due diligence, and seamless integration of teams and systems.

In this blog, we will take a closer look at the essential components of mergers and acquisitions, including the different types of mergers, the M&A process, valuation techniques, and common challenges businesses face. We will also explore how ZoopSign’s tools play a vital role in simplifying and securing the M&A journey, ensuring that transactions are completed with efficiency, accuracy, and compliance.

What Are Mergers and Acquisitions?

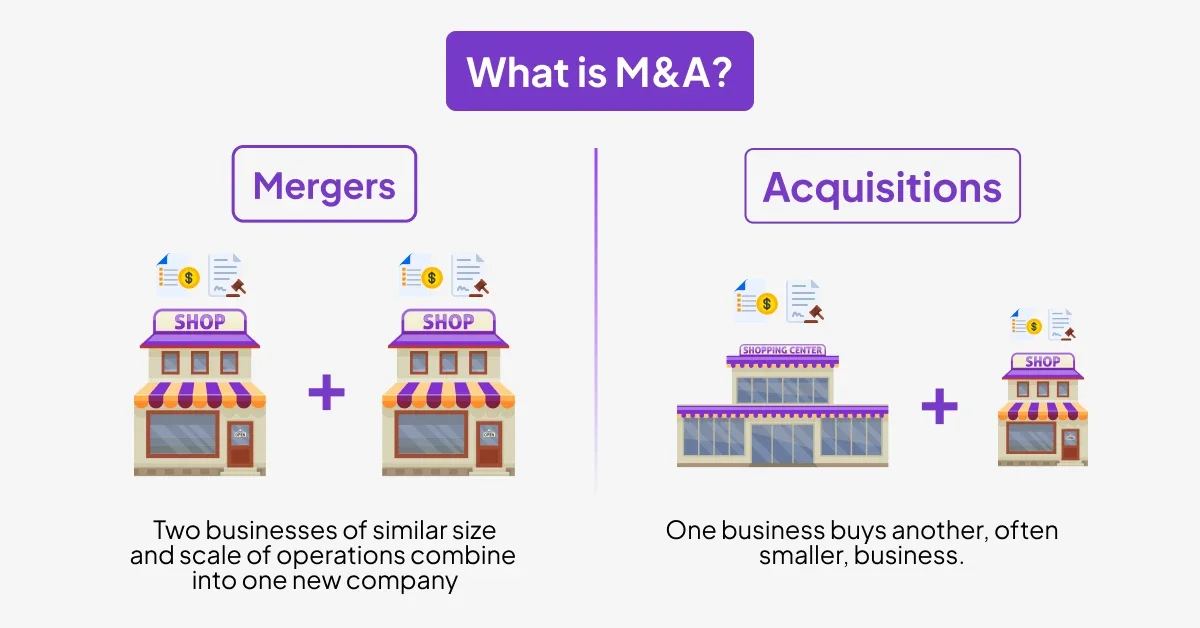

Mergers and acquisitions (M&A) refer to the process by which two or more companies combine (merger) or one company buys another (acquisition). These strategic business transactions are typically pursued to achieve growth, reduce costs, or acquire key assets and technologies.

A merger occurs when two companies combine to form a new entity. This often happens between companies of similar size and market position. For example, when two companies in the same industry decide to pool resources, they may create a larger, more competitive business entity.

An acquisition, on the other hand, is when one company buys another, either by purchasing shares or assets. In an acquisition, the acquiring company usually absorbs the target company, which may continue to operate under its brand or be fully integrated into the acquirer’s structure.

Mergers and acquisitions have played an essential role in reshaping industries, driving consolidation, and increasing competitive advantage.

The Importance of Mergers and Acquisitions

Mergers and acquisitions are integral to the business world, allowing companies to grow, diversify, or enter new markets. These transactions create synergies by combining resources, technologies, talent, and market share. The M&A process typically involves various stages, each requiring careful execution to maximize value and minimize risk. However, the process can become overwhelming, with complex negotiations, extensive due diligence, and contract signing.

This is where ZoopSign’s digital solutions: e-signatures, deal rooms, and secure sharing—come into play. With ZoopSign’s tools, companies can simplify documentation, streamline communication, and ensure compliance throughout the M&A process.

Streamlining Documentation with ZoopSign’s E-Signatures

As you move forward in the M&A process, handling complex legal documentation is key. ZoopSign’s e-signature feature allows parties to sign critical merger agreements quickly and securely. This eliminates the need for physical paperwork, accelerating the signing process and ensuring that all parties are legally compliant.

Types of Mergers

There are several types of mergers, each designed to achieve specific business goals. Understanding the different types of mergers is vital for executives navigating the M&A process.

Horizontal Mergers

A horizontal merger occurs when two companies in the same industry, offering similar products or services, merge to consolidate market power. The goal is often to eliminate competition, achieve economies of scale, and increase market share. For example, when two telecom companies merge to create a more robust network and reduce operational costs.

Vertical Mergers

A vertical merger happens when companies operating at different stages of the supply chain combine. This type of merger can help streamline operations, reduce costs, and improve control over the supply chain. For instance, a car manufacturer acquires a parts supplier.

Conglomerate Mergers

A conglomerate merger occurs when two companies operating in unrelated industries merge. The aim is typically to diversify the company’s portfolio, reduce risk, and tap into new markets or technologies.

Simplifying Collaboration with ZoopSign’s Deal Room

When managing various types of mergers, collaboration across multiple teams and stakeholders is crucial. ZoopSign’s deal room feature securely stores all merger-related documents and offers real-time access to stakeholders. This helps to manage data securely and efficiently, ensuring that everything is in one place for quick reference.

The M&A Process

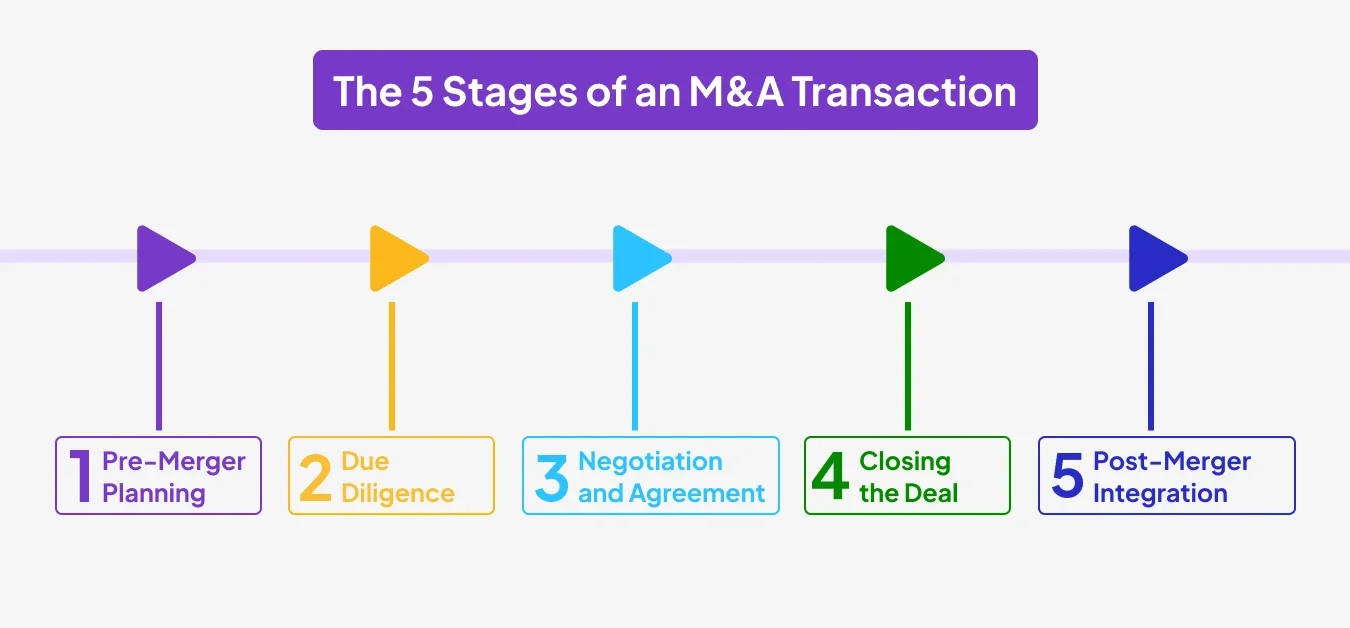

The M&A process can be complex and consists of several stages that require careful planning and execution. Below is an outline of the primary steps involved in any merger or acquisition.

Pre-Merger Planning

- Research and strategy development: Before initiating any transaction, companies must research the market, identify potential targets, and set clear strategic goals for the merger or acquisition.

- Integration: Use zDrive to securely store sensitive data during the planning stage. ZoopSign’s encrypted cloud storage ensures that confidential information is kept secure and easily accessible.

Due Diligence

- Due diligence is the process of reviewing the target company’s financial health, legal status, assets, liabilities, and risks. It is vital for making informed decisions and identifying potential pitfalls.

- Integration: ZoopSign’s secure sharing feature ensures the safe transfer of sensitive documents like financial reports, contracts, and legal files during due diligence.

Negotiation and Agreement

- Key considerations during the negotiation phase include price, terms of the deal, and future integration plans. It is essential to ensure that both parties align on goals and expectations.

- Integration: ZoopSign’s e-signature feature allows for seamless signing of contracts, reducing paperwork delays and accelerating the agreement process.

Closing the Deal

- The final stage involves formalizing the merger or acquisition and completing all regulatory and legal steps to make the deal official. Post-deal actions often involve integrating the companies into a unified entity.

- Integration: ZoopSign’s deal room can be used to track all closing documents, contracts, and communications, ensuring transparency throughout the closing process.

Valuation Techniques

Valuing a company is one of the most critical aspects of an M&A transaction. The valuation process helps determine the price to be paid and the worth of the assets being acquired.

Discounted Cash Flow (DCF)

- The DCF method involves estimating the future cash flows of a company and discounting them to their present value. This technique is commonly used to value companies with predictable cash flows, such as utilities.

Comparable Company Analysis (CCA)

- This method compares the target company to similar companies in the market. The idea is to determine the value based on how other companies with similar attributes are valued in the market.

Precedent Transactions Analysis

- This technique examines past M&A transactions of similar companies to assess a fair valuation. By comparing the target company to past deals, this method can help determine a reasonable price for the merger or acquisition.

Secure Storage of Valuation Reports with ZoopSign’s zDrive

The valuation process often involves sensitive data and reports. ZoopSign’s zDrive ensures that all valuation reports are securely stored in an encrypted cloud environment, giving real-time access to authorized stakeholders and ensuring data confidentiality.

Common Challenges in M&A

While mergers and acquisitions offer great potential for growth and synergies, they come with a variety of challenges that need to be addressed for a successful outcome.

Cultural Integration

- Merging two companies often means merging two distinct corporate cultures. Cultural differences can create friction, affect employee morale, and impact the success of the merger.

- Integration: Using ZoopSign’s deal room can help centralize communication, ensuring that teams collaborate effectively and maintain transparency during the integration phase.

Financial Misalignment

- Misvaluations, inaccurate forecasting, or improper financial integration can lead to significant issues post-merger. Companies must ensure that they align their financial systems and models during the M&A process.

Communication Barriers

- Effective communication is vital for successful M&A. Miscommunication or lack of information sharing can delay the integration process and lead to confusion among stakeholders.

- Integration: ZoopSign’s secure sharing and deal room features help facilitate clear communication and ensure that all stakeholders are on the same page.

Tax Implications of Mergers

Tax considerations are a crucial aspect of any merger or acquisition. Understanding the tax implications can help businesses structure their deals more efficiently and minimize tax liabilities.

1. Tax Benefits

- Mergers can provide certain tax benefits, such as deductions for transaction costs and depreciation of assets.

2. Potential Risks

- Tax risks include changes in tax rates, loss of tax credits, or issues arising from cross-border transactions. Companies must conduct thorough due diligence on tax regulations to avoid costly surprises.

ZoopSign’s Secure Sharing for Tax Documents

For tax-related documents, the secure sharing feature in ZoopSign ensures the safe transfer of sensitive tax filings and agreements, allowing all parties to access the necessary documents without compromising security.

How ZoopSign’s Solutions Transform M&A Processes

ZoopSign’s suite of digital solutions significantly enhances the M&A process by making it faster, more efficient, and more secure. From e-signatures to secure document storage and sharing, ZoopSign ensures that every step of the merger process is executed smoothly.

- E-Signature: Speed up contract signing with legally compliant electronic signatures that save time and reduce paperwork delays.

- Deal Room: Collaborate securely with all stakeholders by centralizing data storage for contracts, reports, and communication.

- Secure Sharing: Ensure confidential sharing of sensitive documents like financial statements or legal agreements without compromising security.

- zDrive: Safeguard critical files with encrypted cloud storage that provides real-time access to authorized personnel.

Mergers and acquisitions are complex processes that require careful planning, strategic thinking, and thorough execution. From understanding the types of mergers to navigating the valuation and negotiation stages, each part of the M&A process plays a vital role in determining the outcome of the transaction.

By leveraging ZoopSign’s e-signature, deal room, and secure sharing features, businesses can ensure that their M&A transactions are completed securely and efficiently, minimizing risks and maximizing value.