Mergers and acquisitions – commonly called M&A – are among the most significant events in the business world. From headline-making corporate takeovers to startups being acquired for billions, M&A deals can redefine industries and accelerate growth overnight.

But how exactly does an M&A deal happen from start to finish? In this guide, we’ll walk through the full M&A process step by step, breaking down everything from strategy and target identification to closing and post-merger integration. Whether you’re a finance professional, a startup founder considering an exit, or just curious how M&A works, this overview will demystify the journey in a conversational, easy-to-understand way.

What is M&A and Why Does It Matter?

Mergers and Acquisitions (M&A) refer to the process of two companies combining (a merger) or one company purchasing another (an acquisition). In a merger, two firms join to form a new single entity (often to pool resources and gain a competitive edge), whereas in an acquisition one company outright buys and absorbs another.

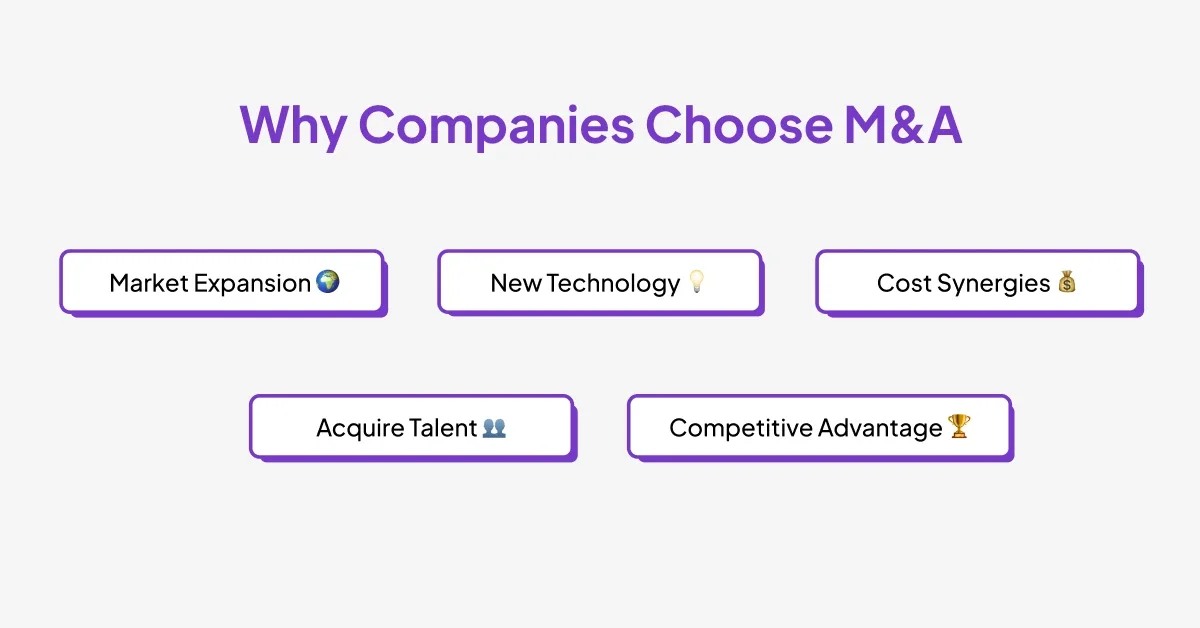

M&A is a key growth strategy for many organizations – instead of growing slowly organically, companies can acquire another business to leap forward in market share, enter new markets, access new technology, or achieve synergies (when the combined company is more valuable than the two separate firms).

For example, a large tech company might acquire a smaller startup to quickly obtain innovative technology rather than spend years developing it in-house. M&A deals can create enormous value and reshape industry landscapes.

Why is M&A so important? M&A helps companies stay competitive. It’s often the fastest way to scale up, diversify product lines, or fend off competition. Successful mergers or acquisitions can cut costs by combining operations, expanding customer bases, and generating new revenue streams.

They’re the reason we see giants like Disney-Pixar (entertainment synergy) or Facebook acquiring Instagram (social media expansion) – strategic acquisitions can propel a company to the forefront of its industry. However, M&A is also complex and risky.

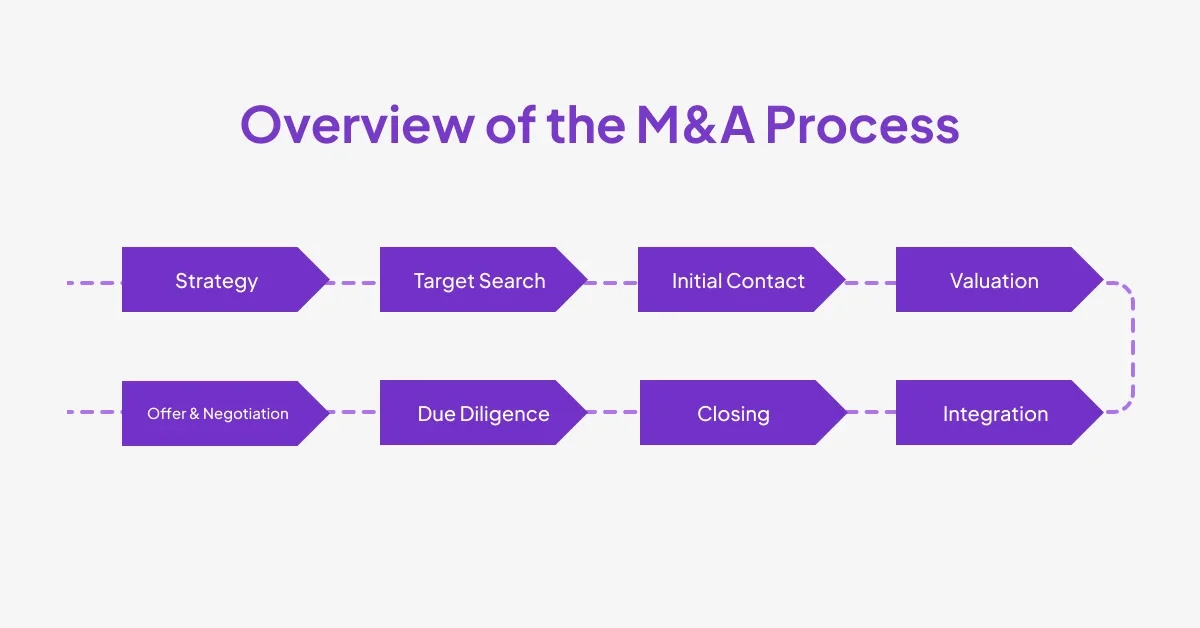

Complete 8-Steps M&A Process

Step 1: Developing a Clear M&A Strategy

Every successful merger or acquisition starts with a clear strategy. This means the acquiring company (the one looking to buy or merge with another) has thought hard about why it wants to pursue an M&A deal and what it hopes to achieve. Essentially, the acquirer needs to answer: “How will an acquisition serve our business goals?”

Common strategic reasons for M&A include: expanding into new markets or regions, acquiring new product lines or technologies, consolidating with a competitor to increase market share, diversifying offerings to reduce risk, or achieving cost synergies by combining operations.

For instance, if a U.S.-based company wants to establish a presence in Asia, it might consider acquiring a local Asian firm rather than setting up from scratch – the acquisition provides instant market entry, local expertise, and customers. Similarly, a company struggling with a supply chain might acquire a key supplier (vertical integration) to gain more control and reduce costs.

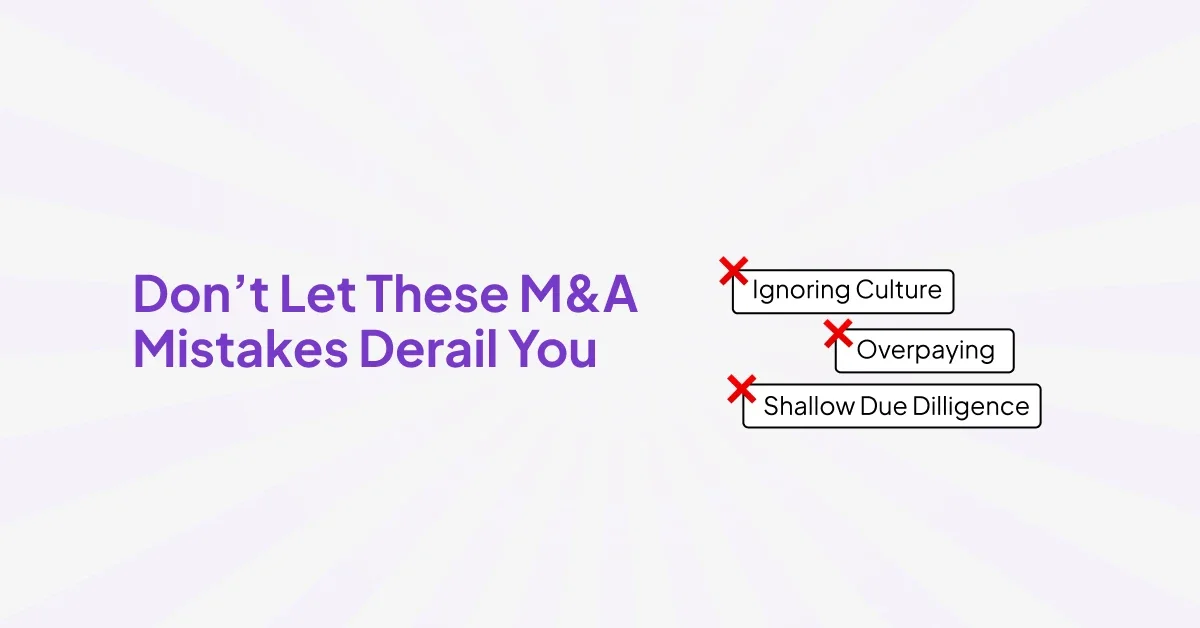

At this strategy development stage, the company’s top executives (CEO, CFO, Corporate Development team, etc.) outline the business case for an acquisition. They define clear objectives for the M&A initiative. For example, the goal could be “acquire a company with $50M–$100M in annual revenue in our industry to boost our market share by 15%” or “merge with a firm that has complementary technology to ours, so we can offer a broader product suite.” Having well-defined goals and criteria will guide all subsequent steps and keep the process focused. Skipping this planning often leads to chasing the wrong deals or overpaying for an acquisition that doesn’t actually fit the company’s needs.

Step 2: Identifying and Screening Target Companies

With a clear strategy in hand, the next step is to identify potential target companies that fit the acquirer’s criteria. This is akin to making a wish list of companies that could be suitable candidates for merger or acquisition. The acquirer will establish search criteria based on its strategy – for example, targets within a certain industry or niche, of a particular size (revenue or number of customers), in specific geographic regions, with a desired profit margin range or technology capability.

Using the earlier example, if the strategy is to expand into Asia by acquiring a local player, the search criteria might include: companies in the same industry located in key Asian markets, with say $50–$100 million in annual revenue and a strong distribution network in their country. If the goal is to add a new product line, the criteria might focus on companies that have a complementary product and a solid customer base in that space.

Step 3: Initial Contact and Preliminary Discussions

After identifying a promising target company, the acquirer moves to make initial contact and start preliminary discussions. This step is essentially “testing the waters” to see if the target is open to a deal and to gather more information discreetly. How this contact happens can vary. Sometimes the acquiring company’s CEO or another executive might call up their counterpart at the target company to express interest in a possible deal. In other cases – especially for larger deals – an investment banker or intermediary might reach out on behalf of the acquirer to gauge the target’s receptiveness.

The purpose of these initial discussions and info exchange is to allow the acquirer to perform a quick preliminary evaluation of the target. Often, the acquirer is trying to answer questions like: Does the target’s detailed info confirm our initial positive impression? Are there any immediate concerns that would kill the deal (like big debts or lawsuits)? And, roughly, what might this company be worth to us?

Step 4: Valuation and Analysis of the Target

With preliminary data in hand and the target amenable to further talks, the acquiring company now dives into a more detailed valuation and analysis of the target business. This step is all about figuring out how much the target company is worth to the acquirer, and what price the acquirer can justify paying. It’s a critical step – come in with too high or too low a valuation, and the deal could either become uneconomical or fail to entice the seller.

The acquirer’s finance team (often with the help of investment bankers or financial analysts) will typically use several valuation methods to assess the target’s value.

Common techniques include:

- Discounted Cash Flow (DCF) Analysis: Projecting the target company’s future cash flows and discounting them to present value. This method looks at the company’s ability to generate cash in the future, which is a fundamental driver of value.

- Comparable Companies Analysis: Looking at valuation multiples of similar companies in the industry. For instance, if companies in this sector are generally valued at 5 times their EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), how does the target compare? This gives a ballpark range based on market norms.

- Precedent Transactions: Examining recent M&A deals in the same industry – what prices (as multiples of earnings, sales, etc.) were companies like our target acquired for? This can help gauge what the market might pay for the target.

- Asset-based valuation: In some cases, especially if the target has significant tangible assets, the acquirer might look at the book value or replacement cost of those assets as a floor for the valuation.

Step 5: Making the Offer and Negotiating Terms

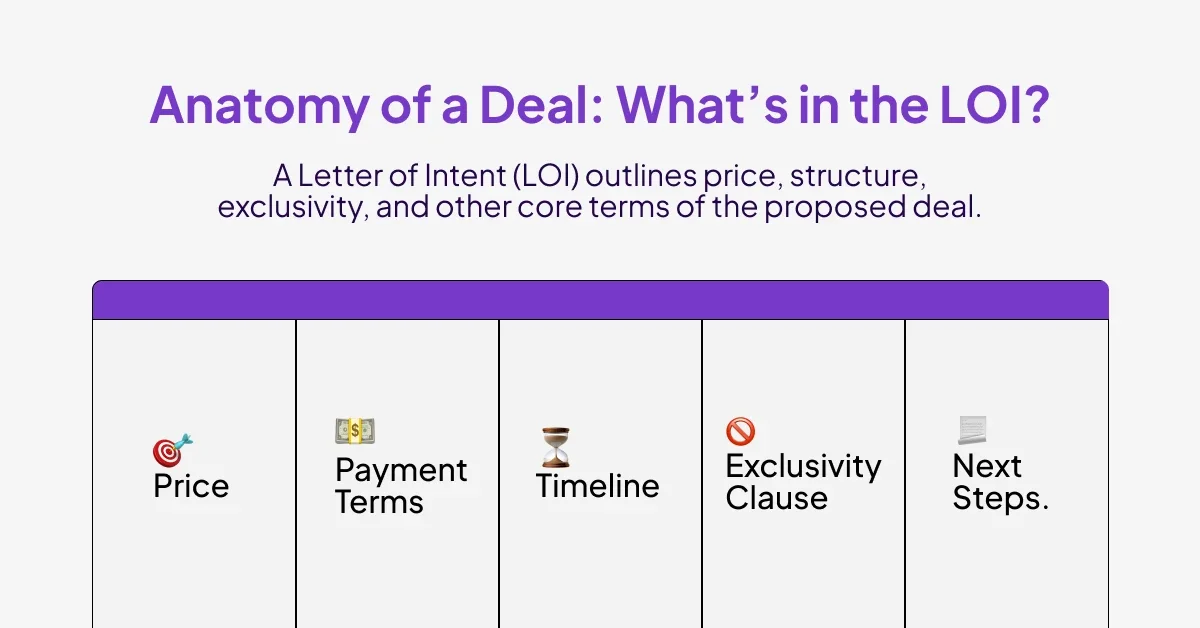

Armed with analysis and a tentative deal plan, the acquiring company is ready to make an offer to the target. In practice, this often takes the form of a Letter of Intent (LOI) or a term sheet – a written proposal that outlines the key terms of the deal being proposed.

The LOI will typically state the proposed purchase price (or price range, or formula if stock is involved), the form of payment (cash, stock, etc.), and other fundamental terms like any key conditions or exclusivity period for due diligence. It’s usually non-binding (meaning either party can walk away until a final contract is signed), but it signals serious intent and is the starting point for detailed negotiations.

Example: “Acme Corp offers to acquire all outstanding shares of Beta Inc. for $60 million in cash, pending satisfactory due diligence. Upon signing this letter, Beta Inc. agrees not to solicit or engage in acquisition offers from other parties for a 60-day period while we negotiate final agreements and conduct due diligence.” That’s a simplified gist of an LOI – it sets the stage for next steps.

Typically, at the conclusion of successful initial negotiations, both parties sign the Letter of Intent or a Memorandum of Understanding (MOU) that captures the main agreed-upon terms. This document often grants the acquirer exclusive rights to pursue the deal for a period of time (30, 60, 90 days, etc.), meaning the target won’t talk to other potential buyers during that period. It’s during this exclusivity window that the acquirer will conduct in-depth due diligence and work with the target to finalize the definitive agreement. So, once the LOI is signed, we move into the next critical stage: due diligence.

Read Blog: Contract vs Agreement: Everything you Need to Know!

Step 6: In-Depth Due Diligence

Due diligence is a deep-dive investigation into the target company’s affairs – it’s perhaps the most important phase to confirm everything is as expected (or uncover any issues) before the deal is sealed. Think of it as a thorough home inspection before you buy a house, but on a much larger scale. After an LOI is signed and the basic terms are set pending due diligence, the acquirer and their team of experts will comb through every aspect of the target’s business. The goal is to verify the target’s financial, legal, and operational health and to identify any risks or deal-breakers that weren’t obvious before.

Step 7: Finalizing the Deal – Documentation and Contracts

With due diligence completed satisfactorily, the M&A process moves into final documentation. This is where lawyers for both sides take center stage to draft and negotiate the definitive purchase agreement (sometimes called the purchase and sale contract, or merger agreement if it’s structured as a merger).

Key elements typically covered in the purchase agreement include:

- Purchase Price and Structure: The final agreed price and whether it’s being paid in cash, stock, or a mix. If stock is involved, the exact exchange ratio. If any portion is deferred or conditional (like an earn-out or seller financing), those terms are detailed.

- Closing Details: The expected closing date or timeframe, and conditions precedent to closing – i.e., what needs to happen before the deal is officially consummated. Common conditions include regulatory approvals (e.g., antitrust clearance by government regulators if the companies are large), shareholder approvals (if required by corporate law or for publicly traded firms), and the absence of any material adverse change in the target’s business before closing.

- Representations and Warranties: These are statements of fact that each party asserts are true at the time of signing and again at closing. For example, the seller will “represent” things like “our financial statements are accurate,” “we have disclosed all material liabilities,” “we have title to all our assets,” etc. If any of those representations turn out to be false later, it can give rise to legal remedies. The buyer will also make certain representations (like “we have authority to execute this deal,” “we have the funds available,” etc.).

- Covenants: These are promises about actions between signing and closing (and sometimes after closing). For instance, the target company often covenants that it will operate in the ordinary course and not make any major changes before closing without the buyer’s consent (so the business the buyer gets at closing is the same one they agreed to buy). There could also be covenants about employee treatment, integration planning, or public announcements.

- Indemnification Provisions: These specify what happens if post-closing it turns out some representation was wrong or there was an undisclosed liability. Essentially, who pays for what if something goes awry after the fact. Often, the seller might agree to indemnify (reimburse) the buyer for certain losses if, say, a hidden liability emerges post-deal. There might be escrow arrangements where part of the price is held in escrow for a period to cover any such claims.

- Termination Rights and Fees: The agreement will outline under what conditions either party can walk away (terminate the deal) before closing, and whether any break-up fees apply. For example, if the seller gets a much better offer from someone else and wants to back out, there might be a contract clause allowing it if they pay the buyer a termination fee. Or if regulatory approval fails, both can walk with no penalty, etc.

To know more about the types of Contracts in detail, read our blog

Step 8: Closing the Deal (Financing and Final Steps)

“Closing” is the moment everyone has been working toward – when ownership of the target company actually transfers to the acquirer, money changes hands, and the merger/acquisition becomes legally effective. In practice, there may be a gap between signing the definitive agreement (Step 7) and the closing date, or they might happen simultaneously, depending on the deal. Many deals are signed and closed on the same day (especially smaller private deals where conditions can be met immediately), whereas others have a signing, then a waiting period for approvals, then closing.

Leading up to closing, a few important things happen:

- Satisfying Conditions: Both sides work to meet any outstanding conditions set in the purchase agreement. For example, if regulatory approval was required, they await and obtain it. If the company’s shareholders need to vote to approve the transaction (common in public company deals), a shareholder meeting is held and approval is obtained. If there were any specific actions the seller had to take (like divesting a certain division or resolving a particular issue), those need to be done. All these must be completed before the closing can occur.

- Financing the Purchase: The acquirer ensures the funds are ready. If the deal is being financed through a loan or bond issue, those funds are drawn down. If paying in stock, the acquirer might be prepping to issue new shares or swap shares. Essentially, the buyer lines up the cash (and any stock certificates or other form of payment) so that it can pay the seller at closing. (In many cases, the money might be sitting in escrow with a third-party agent ready to be released upon closing.)

- Closing Logistics: A closing date is scheduled. Typically, at closing, a number of documents are exchanged. The seller will deliver things like stock certificates or asset titles to transfer ownership, signed resignations of board members (if management is changing), updated financial statements up to the close date, etc. The buyer will deliver the payment (wire transfer of funds, etc.) and signed documents that might have been agreed to be delivered at closing.

Here is our Complete Merger and Acquisition Guide.

When everything is in order, the parties consummate the deal. Funds are transferred to the seller, and the buyer legally takes ownership of the target’s shares or assets. Often a closing memorandum is signed to acknowledge that all conditions are met and the deal is now closed.

For teams embarking on an M&A, having the right advisors and the right technology in your corner can make all the difference. As you strategize your next acquisition or plan a merger, consider how a solution like ZoopSign can modernize your M&A workflow – keeping everything from early negotiations to final closing secure, organized, and lightning-fast. M&A might be a complex process, but with thorough preparation and the proper merger tools, you’ll be well-equipped to navigate it successfully.

Ready to manage your M&A deals with greater confidence and security?

Explore how ZoopSign’s secure deal rooms, e-signature capabilities, and document tracking can empower your next merger or acquisition. With the right process and technology in place, you can turn your M&A ambitions into a successful reality.